What is Kuva?

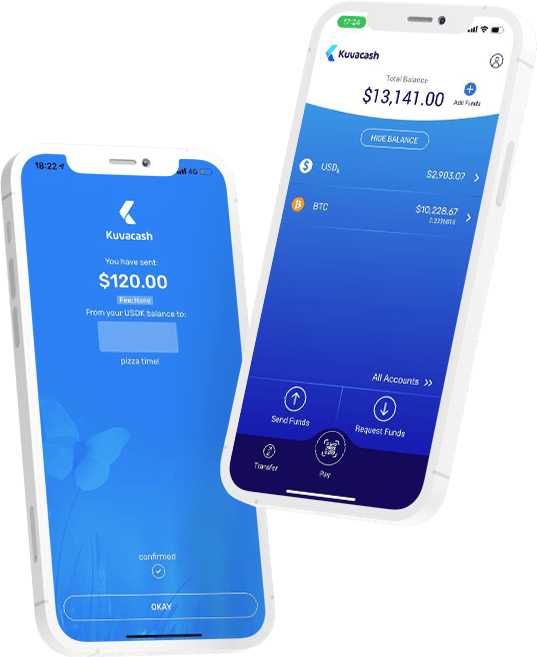

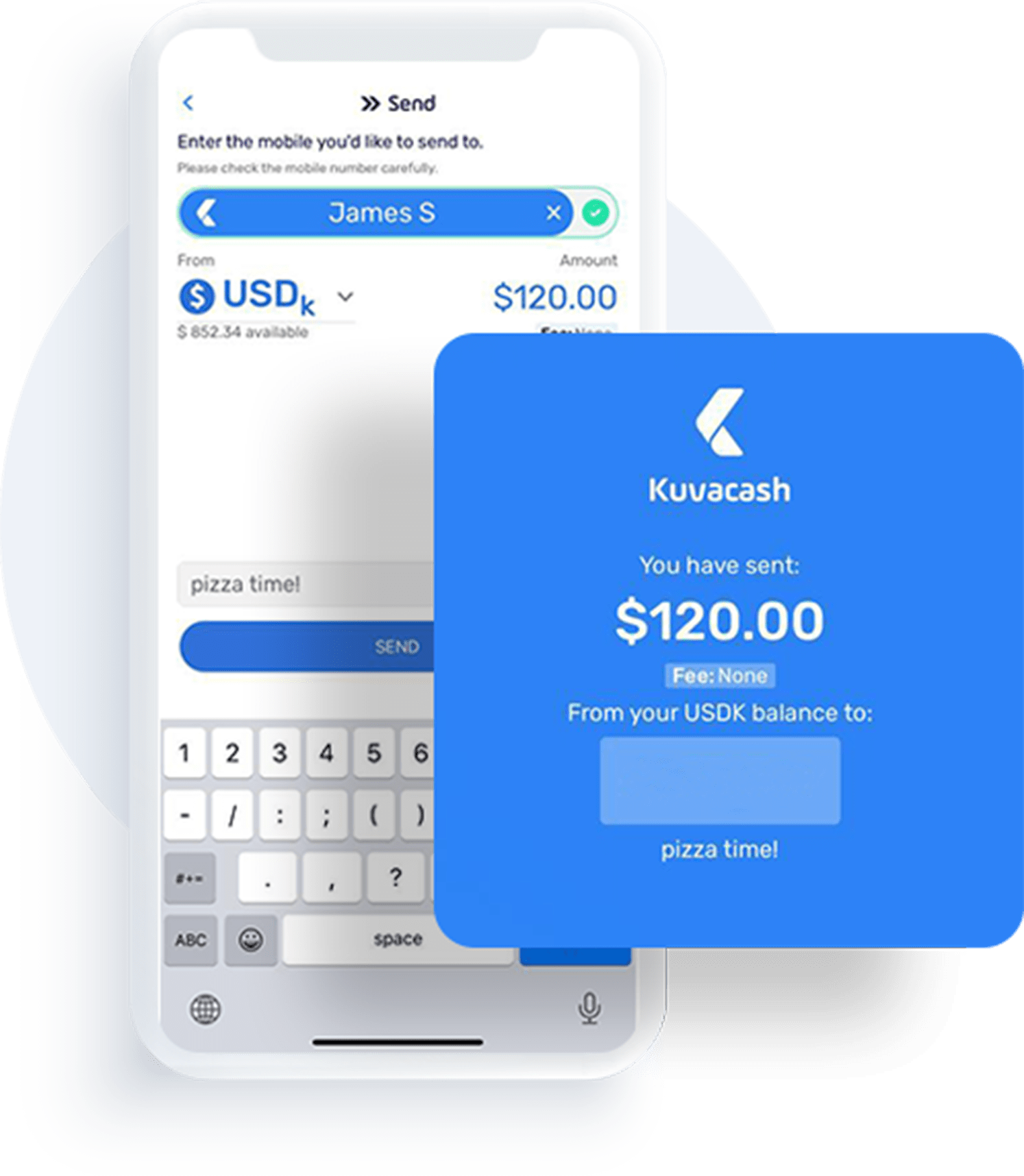

Instant and secure payments

Kuva gives you the opportunity to send and receive money instantly and securely. With Kuva you can now transfer funds with just a phone number to family, friends and suppliers.

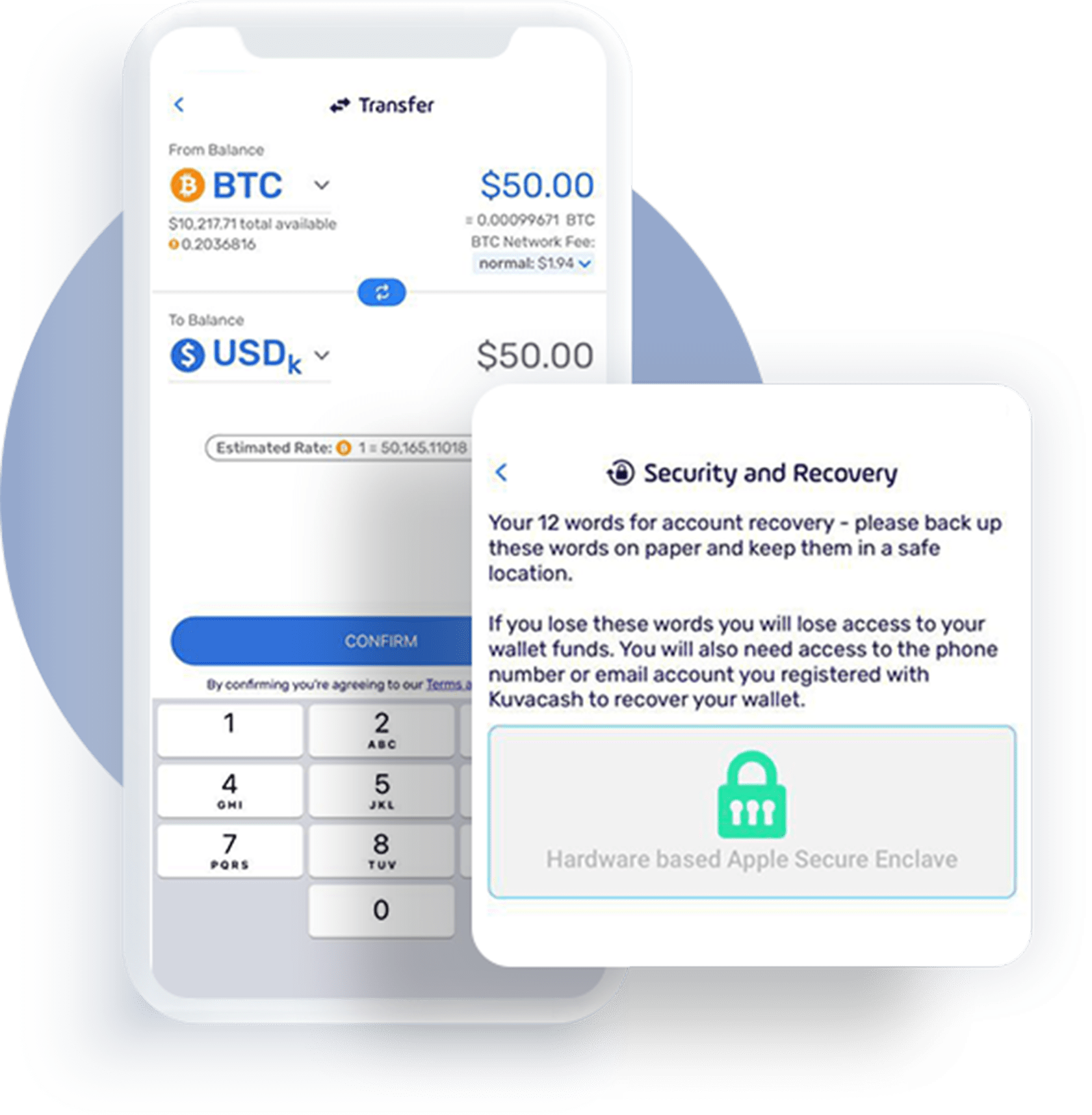

Multiple currencies to trade or pay with

Pay in any currency you prefer.

We’re making money better

Kuvacash is non-custodial, which means you have full control of your money and there are no hidden fees. As we said, it’s your money, your way!

Partners & media coverage

Kuva’s institutional blockchain-based platform powers international cross-border payments, remittances, and deliverable foreign exchange.

3 Feb 2022

Kuva launches Kuva Local in Kenya, Ethiopia, Namibia, and South Africa to facilitate diaspora trade

Kuva launches Kuva Local in Kenya, Ethiopia, Namibia, and South Africa to facilitate diaspora trade

24 Jan 2022

Rethinking the longevity of cryptocurrency’s pay-for-processing model

Rethinking the longevity of cryptocurrency’s pay-for-processing model

24 Jan 2022

Finanzas tradicionales y bitcoin, una «convivencia beneficiosa» para las personas

Finanzas tradicionales y bitcoin, una «convivencia beneficiosa» para las personas

19 Jan 2022

An Interview With Jamie Hemmings

Inspirational Black Men In Tech: James Saruchera of Kuva On The Five Things You Need To Know In Order To Create A Very Successful Tech Company

Our team

Kuva has a team of 20+ staff across Europe, Africa and Latin America. Supported by the full team compliment, here are a few faces you might come across.

Andreiko Kerdemelidis

Group CEO

Nqobani Moyo

Managing Director – ZW

Georgios Giannoukakos

CFO

Chathurika Perea

Head of Delivery

Sergey Medintsev

Senior Analyst

Dr. Spyridon Antonopoulos

Advisor – Regulatory Affairs

Dr. Alexander Slipchenko

Chief Technical Officer

Julio Duran

President Kuva LatAm

Platon Sipsas

Head of Mobile

Tendai Nyamangara

Business Development

Darryl Dzapasi

Marketing Executive